Exactly How Livestock Threat Security (LRP) Insurance Can Protect Your Livestock Financial Investment

Livestock Danger Defense (LRP) insurance policy stands as a dependable guard against the unpredictable nature of the market, offering a tactical approach to protecting your possessions. By diving right into the details of LRP insurance policy and its complex benefits, animals manufacturers can fortify their financial investments with a layer of safety that goes beyond market changes.

Comprehending Livestock Danger Protection (LRP) Insurance Policy

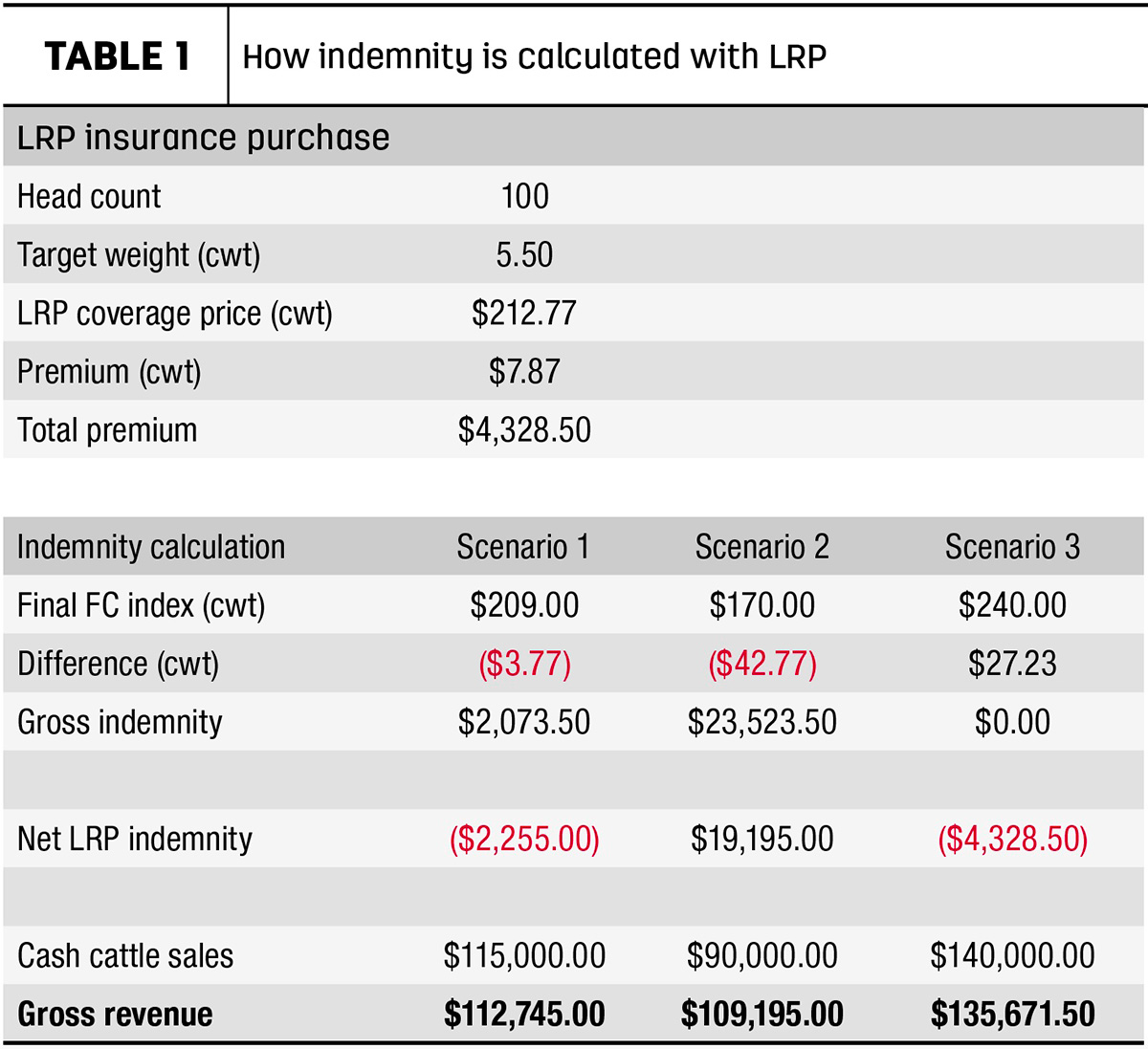

Understanding Animals Threat Security (LRP) Insurance coverage is important for animals producers looking to minimize monetary dangers related to rate changes. LRP is a government subsidized insurance item developed to protect manufacturers against a decrease in market prices. By giving protection for market rate declines, LRP aids producers secure a flooring rate for their livestock, guaranteeing a minimal level of earnings no matter market variations.

One key element of LRP is its flexibility, enabling manufacturers to personalize coverage degrees and policy sizes to suit their certain requirements. Producers can choose the number of head, weight variety, coverage rate, and coverage period that line up with their production goals and run the risk of tolerance. Understanding these customizable choices is critical for producers to successfully handle their rate risk exposure.

Additionally, LRP is available for different animals types, including livestock, swine, and lamb, making it a functional risk administration device for animals manufacturers throughout various markets. Bagley Risk Management. By familiarizing themselves with the ins and outs of LRP, manufacturers can make enlightened decisions to guard their investments and guarantee economic security in the face of market unpredictabilities

Advantages of LRP Insurance for Livestock Producers

Livestock producers leveraging Livestock Threat Security (LRP) Insurance policy gain a tactical benefit in securing their financial investments from price volatility and protecting a secure financial footing amidst market uncertainties. By establishing a flooring on the cost of their livestock, producers can minimize the threat of significant financial losses in the occasion of market recessions.

Furthermore, LRP Insurance coverage offers producers with tranquility of mind. On the whole, the advantages of LRP Insurance for animals manufacturers are substantial, offering a valuable tool for managing danger and ensuring monetary protection in an uncertain market environment.

Exactly How LRP Insurance Mitigates Market Dangers

Mitigating market risks, Animals Danger Security (LRP) Insurance coverage supplies livestock manufacturers with a reliable shield versus cost volatility and economic uncertainties. By offering security versus unforeseen rate declines, LRP Insurance aids producers secure their financial investments and preserve financial stability when faced with market changes. This type of insurance coverage permits livestock producers to secure a cost for their animals at the start of the plan period, making sure a minimum price level no matter of market modifications.

Actions to Safeguard Your Animals Financial Investment With LRP

In the realm of farming threat management, applying Livestock Danger Protection (LRP) Insurance coverage includes a calculated process to secure investments against market fluctuations and uncertainties. To secure your livestock investment effectively with LRP, the primary step is to examine the specific threats your operation deals with, such as cost volatility or unforeseen climate occasions. Comprehending these risks permits you to establish the coverage degree needed to secure your investment properly. Next, it is critical to research and select a credible insurance copyright that uses LRP policies customized to your animals and service needs. Thoroughly assess the plan terms, problems, and insurance coverage restrictions to guarantee they align with your risk management objectives when you have selected a copyright. Additionally, consistently keeping track of market fads and readjusting your coverage as required can assist enhance your defense versus potential losses. By adhering to these steps faithfully, you can enhance the safety and security of your animals investment and browse market uncertainties site link with confidence.

Long-Term Financial Safety And Security With LRP Insurance Policy

Making sure enduring economic stability through the usage of Livestock Danger Defense (LRP) Insurance coverage is a prudent long-lasting strategy for farming manufacturers. By including LRP Insurance policy into their danger monitoring strategies, farmers can guard their livestock financial investments versus unanticipated market variations and damaging occasions that can endanger their financial wellness gradually.

One key advantage of LRP Insurance policy for long-lasting monetary security is the comfort it offers. With a dependable insurance coverage policy in location, farmers can mitigate the economic threats connected with unpredictable market problems and unforeseen losses as a result of aspects such as disease outbreaks or natural disasters - Bagley Risk Management. This security allows manufacturers to concentrate on the daily procedures of their livestock business without constant bother with possible monetary obstacles

Furthermore, LRP Insurance offers a structured method to taking care of danger over the lengthy term. By setting certain protection degrees and picking ideal recommendation periods, farmers can tailor their insurance coverage prepares to align with their financial objectives and take the chance of tolerance, making certain a lasting and protected future for their livestock procedures. To conclude, purchasing LRP Insurance policy is an aggressive strategy for farming manufacturers to attain long lasting monetary safety and safeguard their source of incomes.

Conclusion

In final thought, Animals Danger Protection (LRP) Insurance policy is a valuable device for animals manufacturers to mitigate market risks and secure their financial investments. It is a sensible selection for safeguarding Clicking Here livestock investments.